This is a 2-part series on why you should invest.

Part 1

The best time to invest was yesterday, the next best time is NOW. No matter what, start as soon as possible. Being an investor is a choice you make, likewise becoming a borrower. Investment is simply starving your now to fund your future. The ball is in your court, choose wisely!

Let your goals drive your investments. My advice is to create baskets of investments for your goals. For instance, a basket for your retirement (and yes, it’s never too early), for building a home, for your business, your children’s fees, for unlikely events etc. Without having goals, every money you make will find an unnecessary venture.

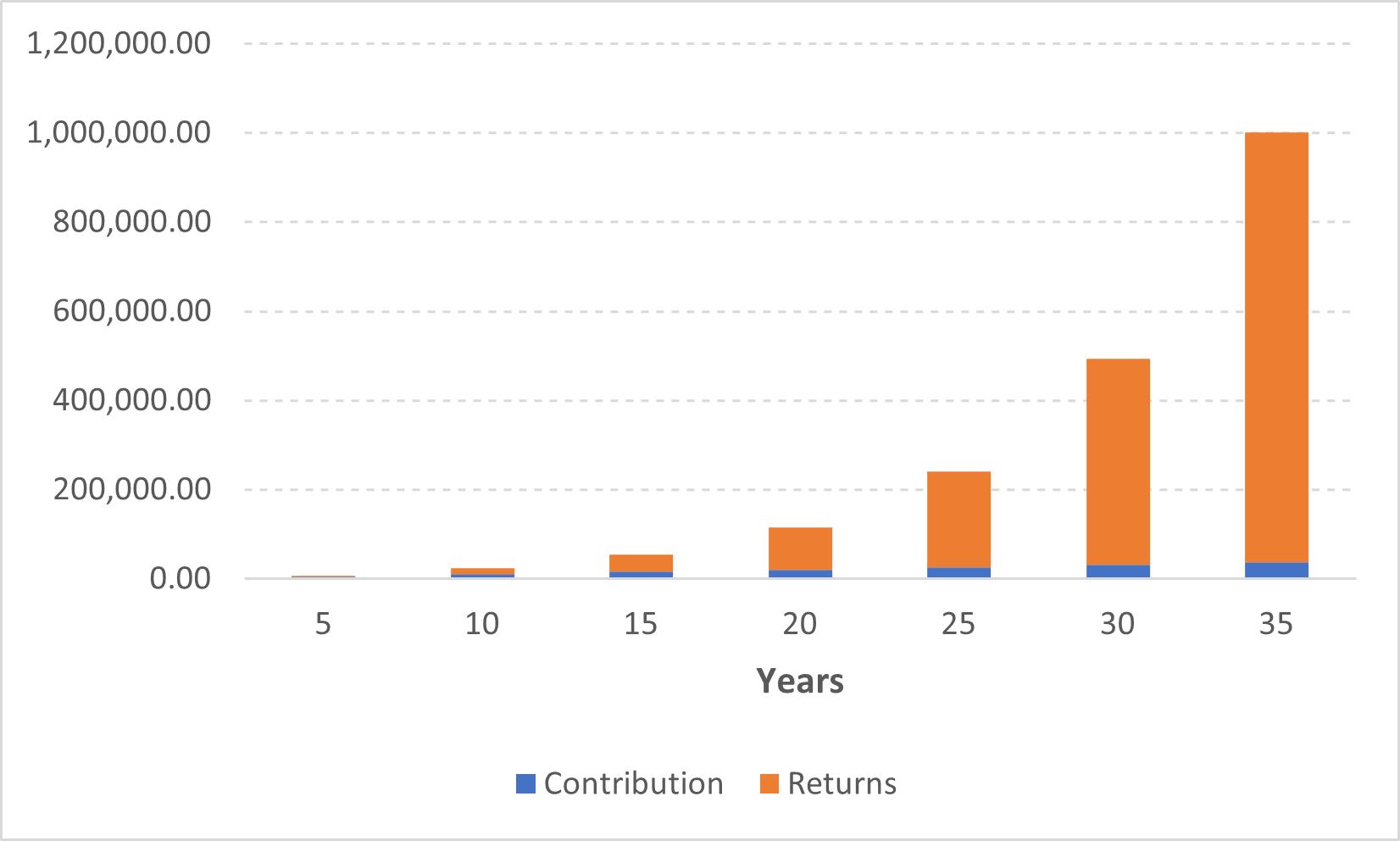

No amount is too small. Consistency is key especially at the beginning. Learn to work for your investments until your investments start working for you. Here’s a scenario, Let’s assume an interest rate of 15% per annum. Now say I am 25 years old and I want to hit GHS1 million by retirement (which is 60 years). I will have to contribute GHS87.20 to my retirement basket monthly to reach this goal. But here’s the catch, my contributions over the period will only be GHS36,714.00 while my returns portion will be a whooping GHS963,737.00.

Compounding interest is what makes investments worthwhile and you enjoy this more with time. Compound interest means that your investments grow exponentially and not linearly. The scenario I showed earlier and the figure below explains this point.

In Ghana, savings accounts are not investments. Always use inflation as your benchmark at the very least. Most savings accounts earn interest below the inflation rate. A yearly inflation of 10% means that the currency has lost 10% of its value over the past year. Consequently, you need an extra GHS10 to buy something that was worth GHS100 a year ago. You should always go for an investment higher than the inflation rate. If not, buy land or something that will appreciate in value, or just use the cash.